![]()

![]()

Using SapphireIMS, the depreciation of assets can be computed. Asset depreciation in CMDB module calculates the depreciation of assets based on the following methods:

Declining Balance

Double Declining Balance

Straight Line

Sum Of The Years Digits

The depreciation calculation procedure performs the asset depreciation calculation based on the cost details provided such as 'Asset Cost', 'Current Cost', 'Salvage Value', 'Purchase Date' and the depreciation method selected. The depreciation scheduler enables the calculation of asset depreciation based on the scheduling interval.

Depreciation can be calculated for both pre-shipped and custom asset types.

The first step is to enable the Depreciation Scheduler.

Under 'Settings', in 'Assets', click on 'Depreciation Configuration'. The scheduler screen is displayed.

Enable the depreciation scheduler and change the default scheduling interval if required.

Click on 'Save'.

Add the cost related fixed fields under the 'Cost Details' component which are 'AssetCost', 'CurrentCost', 'SalvageValue'. and the purchase related fixed fields under the 'Purchase Details' component like 'PurchaseDate', 'InvoiceDate', 'GRNDate'. Refer to the topic Settings->Service Desk Configuration->Assets->CI Types and Attributes for the steps to add the fixed fields.

Note: The SalvageValue field

may need to be added as it is not added in the pre-shipped CI Types.

Note: The SalvageValue field

may need to be added as it is not added in the pre-shipped CI Types.

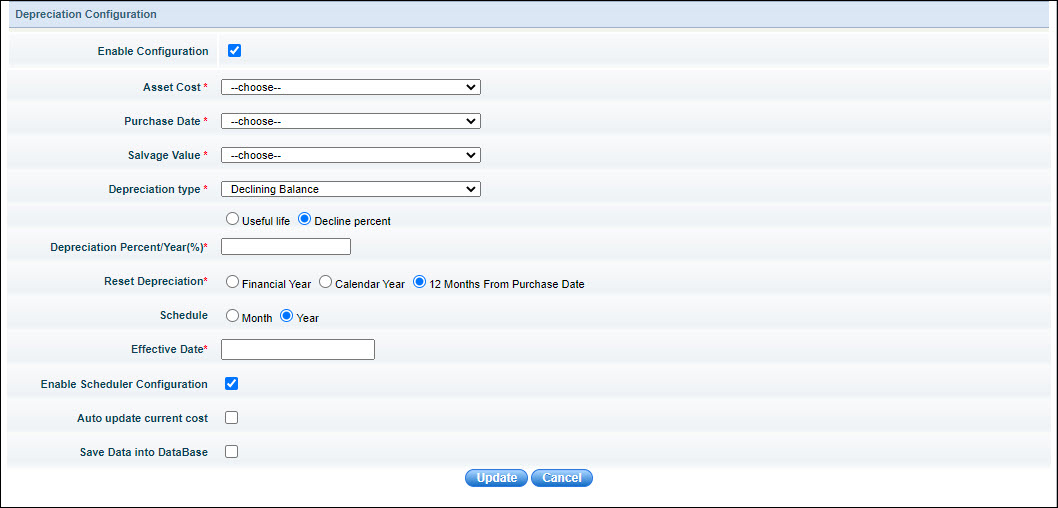

The next step is to configure Depreciation rules. Select 'CI Types and Attributes' in the left hand menu. Click on a CI Type to select. The CI configuration screen opens. Click on the check box 'Enable Configuration' under 'Depreciation Configuration' section. The following screen is displayed.

Select the appropriate field for 'Asset Cost' from the drop down list which is either the cost at purchase or the current cost.

Select the appropriate field for 'Purchase Date' from the drop down list which can be the purchase or invoice or GRN date.

Select the appropriate field for 'Salvage Value' from the drop down list which can be the asset cost or current cost.

Select the 'Depreciation Type'.

Enter the parameters for the depreciation method selected. In the case of 'Straight Line', the 'Useful life' can be selected in months or 'Decline percent' can be specified. If 'Declining Balance' is selected then either the useful life or declining percent can be specified. In addition the depreciation can be reset at the end of the financial year, calendar year or 12 months from purchase date. In 'Double Declining Balance' and 'Sum of the year digits' the useful life can be specified.

Check the box 'Enable Scheduler Configuration' if the asset depreciation has to be automatically calculated as per the schedule

Check the box 'Auto update current cost' if the current cost has to be automatically updated.

Check the box 'Save Data into DataBase' if the depreciation data has to be saved in the database.

Click 'Update' to save the depreciation configuration.